dc vs va income tax calculator

Traduccion disponible en tu idioma. Washington DC Bonus Tax Aggregate Calculator Change state This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Child Support Daycare Costs

Learn how to get your shot at VaccinateVirginiagov or call 1-877-VAX-IN-VAMon-Fri 8am - 6pm.

. A State-by-State Comparison of Income Tax Rates. Calculate your expected refund or amount of owed tax. Your average tax rate is 1301 and your marginal tax rate is 22.

Virginia has a progressive state income tax system with four tax brackets that range from 2 to 575. District of Columbias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Additional information about the various components which make up the registration and title fees can be found at the links below.

For example Californias top rate is 133 but youll only pay this on income over 1 million. Virginia State Payroll Taxes. Check your eligibility for a variety of tax credits.

The cost of living is 3 higher in. The remaining states and Washington DC. This tool compares the tax brackets for single individuals in each state.

In-person appointments for OTRs Walk-In Center and the Recorder of Deeds Office can be made here. Enterate como conseguir tu vacuna VaccinateVirginiagov o llamando al 1-877-829-4682 de Lunes-Viernes 8am a 6pm. When you live in DC you will likely go outeat out more often.

Individual Income Tax Service Center. Charge a progressive tax on all income based on tax brackets. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Estimate your federal and state income taxes. Household which pays more than 5700 in federal income taxes although DC residents pay about 200 less according to the. Overview of District of Columbia Taxes.

For more information about the income tax in these states visit the Virginia and District Of Columbia income tax pages. Overview of Virginia Taxes. Here are some of the most crucial differences in the ways that the three states will tax your income.

You can use this tax calculator to. After a few seconds you will be provided with a full breakdown of the tax you are paying. District of Columbia collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Taxable income over 40000 is taxed at a steep 65 tax rate the top rate of 895 is reserved for taxable income over 1000000 Heres what makes DC a mixed picture on taxes. Virginia Capital Gains Tax. Years ago DC used to have higher income tax rates than VA but as youve pointed out its pretty similar now after the last few years of reforms.

Income tax brackets are the same regardless of filing status. Has relatively high income tax rates on a nationwide scale. The more you earn the higher the percentage youll pay in income tax on your top dollars.

4 on the first 10000 of taxable income. Tax rates range from 20 575. Obtaining a Certificate of Clean Hands is.

If you have a car parking fees. District of Columbia Tax Filing Season to Begin on January 24. Your household income location filing status and number of personal exemptions.

Virginia Income Tax Calculator 2021. To maintain your standard of living in Washington-Arlington-Alexandria DC-VA youll need a household income of. 6 on taxable income between 10001 and 40000.

Language translation available TTY users dial 7-1-1. Since the top tax bracket begins at just 17000 in taxable income per. For income taxes in all fifty states see the income tax by state.

This is mostly due to Virginias income tax cap at 575 compared to Washington DCs highest rate of 85 for the bulk of his income. If you make 78000 a year living in the region of Virginia USA you will be taxed 14063. For an in-depth comparison try using our federal and state income tax calculator.

For more information about the income tax in these states visit the Maryland and Virginia income tax pages. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

For income taxes in all fifty states see the income tax by state. There are lots of things to consider. The bracket you fall into will depend on your income level.

Marylands lower standard deduction extra local income tax rates bundled with higher real estate tax rates push it past Virginia as the highest taxes of the three for each income level we analyzed. For an in-depth comparison try using our federal and state income tax calculator. Capital has a progressive income tax rate with six tax brackets ranging from 400 to 1075.

The state excise tax on regular gas in Virginia is 2620 cents per gallon which is the 32nd-lowest in the nation. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Capital gains from the sale of a home for example in Virginia are taxed as regular income which means they will likely face the top rate of 575.

The median Virginia household pays about 300 more than the average US. Certificate of Clean Hands. Were proud to provide one of the most comprehensive free online tax calculators to our users.

Of the three states Washington DC has the highest income taxes. DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ. This center is a gateway for the services and information that personal income taxpayers will need to comply with the Districts tax laws.

To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive. Since the highest rate applies to income over 17000 most Virginia taxpayers will find themselves paying the top rate at least partially.

Unlike the Federal Income Tax District of Columbias state income tax does not provide couples filing jointly with expanded income tax brackets. As of 2019 there are six income tax brackets ranging from 4 to 895.

District Of Columbia Paycheck Calculator Smartasset

Virginia Income Tax Calculator Smartasset

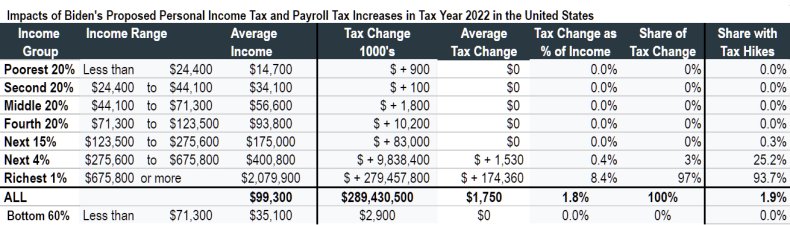

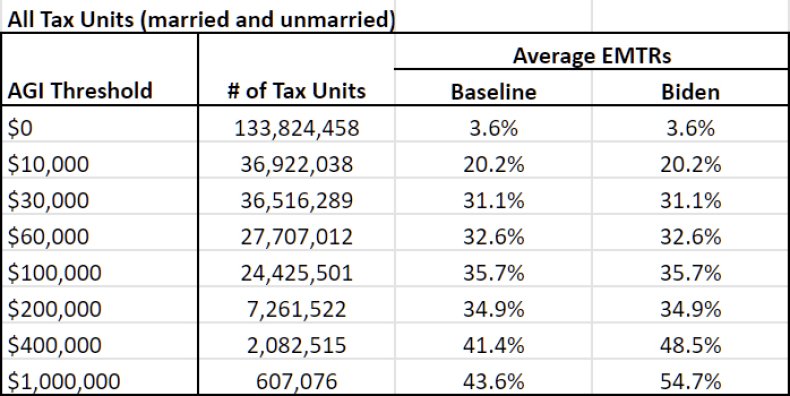

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Hawaii Income Tax Hi State Tax Calculator Community Tax

Llc And S Corporation Income Tax Example Tax Hack Accounting Group

Here S How Much Money You Actually Take Home From A 75 000 Salary Depending On Where You Live Business Insider Budgeting Income Tax

Cryptocurrency Taxes What To Know For 2021 Money

A Knowledgeable Experienced Accounting Firms In Northern Virginia Our Clients Trust Us To Deliver E Mortgage Payment Calculator Accounting Services Budgeting

Delaware Taxes De State Income Tax Calculator Community Tax

Tax Season Is Upon Us Can Gambling Losses Be Deducted Filing Taxes Tax Season Income Tax

New Tax Law Take Home Pay Calculator For 75 000 Salary

Calculating Net Profit After Tax And Why It Is The 1 Metric For Business

Income Tax Return Filing Consultants In Mumbai Income Tax Return Income Tax Return Filing Income Tax

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Http Www Nicholsonolson Com Https Plus Google Com 100311491973099033070 About Hl En Accounting Services Accounting Jobs Accounting And Finance

New Tax Law Take Home Pay Calculator For 75 000 Salary

How To Calculate Taxable Income H R Block

Income Tax Calculator Estimate Your Refund In Seconds For Free